Tips for Travellers in Cairns

Weather

Currency

Money exchange is required to present your passport.

Most money exchange counters are easily located at banks, shopping centres & hotels.

Above are samples of the Australian Dollar notes and coins

Emergency Call – Dial 000

Hospital – Cairns Base Hospital - Upward Street Cairns – tel (07) 4052 5200

24 hours Medical Centre – 156 Grafton Street Cairns – tel (07) 4052 1119

Bank Hours: Mon – Thu 09:30am – 4:00pm Fri – 09:30am – 5:00pm (Sat, Sun & Public Holidays – closed)

ATM – Are located in major banks & shopping centres

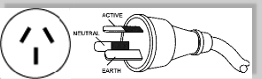

Voltage – 240V

The domestic mains power supply in Australia is 240V AC, 50Hz. Standard 3-pin earthed power outlets are rated at 10Amps and are usually switched. The 3-flat-pin plug is used in all states of Australia.

Pay Phone – can use ($.10, $.20, $.50, $1.00)

International Dialing: 0011 + country code + area code + phone number

Interstate Dialing: area code + phone number

Sydney/Canberra = 02

Melbourne = 03

Adelaide/Perth = 08

Queensland = 07

Shopping Centre:

DFS Galleria Cairns: Mon – Sun 1:00pm – 10:00pm cnr abbott & Spence Streets Cairns – tel (07) 4031 2448

DFO (Direct Factory Outlets): Mon – Sun 9:00am – 5:00pm 274 Mulgrave Road Cairns

Cairns Central – Mon – Sun 9:00am – 5:00pm Mcleod Street Cairns – tel (07) 4041 4111

Supermarket Woolworths – Mon – Fri 08:00am – 9:00pm Sat 8:00am – 5:30pm Sun 9:00am – 6:00pm

103 Abbott Street Cairns – tel (07) 4051 2015

Post Office – Mon – Fri 09:00am – 5:00pm Orchid Plaza 12–14 Lake Street Cairns

Safety:

It is recommended to keep your valuable inside the safety box of your hotel.

Apply sunscreen to your body when doing outdoor activity (use 30+ lotion), also wear hat and sunglasses. 30+ lotion can be purchased from Supermarket or Chemist.

Transportation:

Taxi – dial 131 008 or make your booking from Concierge – Hotel

Taxi Fare – 7:00am – 7:00pm Mon to Fri except public holidays.

Flagfall: $2.70

Distance: $1.96 per km

Time: $0.69 per minute

Booking Charge: $1.40

Taxi Fare – All other times including public holidays except Midnight – 5:00am Mon to Sun

Flagfall: $4.00

Distance: $1.96 per km

Time: $0.69 per minute

Booking Charge: $1.40

Taxi Fare – Midnight – 5:00am Mon to Sun including public holiday except Anzac Day (25th April)

Flagfall: $6.00

Distance: $1.96 per km

Time: $0.69 per minute

Booking Charge: $1.40

Bus

“Sunbus” is the only bus company in Cairns, who operate from Lake Street Transit Centre in City Place. The buses run frequently and until quite late. On Friday and Saturday nights, the main routes north and south run all night. Three types of 24-hour tickets are offered that vary in cost depending on the route you are taking.

Fares are calculated on the number of zones you use in your journey. Take correct change or small notes to pay for your ticket. Tell the bus driver where you want to go and the driver will give you the best zone ticket.

Zone |

Adult single fare |

Concession single fare |

1 |

$1.90 |

$1.00 |

2 |

$2.40 |

$1.20 |

3 |

$2.80 |

$1.40 |

4 |

$3.40 |

$1.70 |

5 |

$4.10 |

$2.10 |

6 |

$4.80 |

$2.40 |

7 |

$5.20 |

$2.60 |

8 |

$5.60 |

$2.80 |

9 |

$6.00 |

$3.00 |

10 |

$7.00 |

$3.50 |

Cairns Season

Season |

Months

|

Temperature *C

|

Spring |

Sep – Oct - Nov |

23 – 28 |

Summer |

Dec – Jan - Feb |

22 – 32 |

Autumn |

Mar – Apr – May |

21 – 27 |

Winter |

Jun – Jul - Aug |

20 – 25 |

Cairns Beaches

The Cairns Northern Beaches stretch for 26km along the beautiful Coral Coast. They begin just north of the city beyond the Barron River Bridge with Machans Beach, followed by Holloways Beach, Yorkeys Knob, Trinity Beach, Kewarra Beach, Clifton Beach, Palm Cove and Ellis Beach. The beaches provide the basis for a huge amount of Cairns’ tourism, and holiday accommodation caters to every budget and desire.

All of the Northern Beaches have pockets of residential dwellings, and most also have comfortable beachfront accommodation. For visitors staying at one of Cairns' northern beaches, there are facilities to meet all your needs. A large shopping centre is located at Smithfield, which is central to all the beaches.

Smoking

Smoking in enclosed workplaces and public areas has been banned by the Act since 1 st January 2005, which is supported by Queensland OH&S legislation.

Customs & Prohibited Items

Do:-

Make yourself aware of Customs, quarantine (Agriculture), wildlife, currency and duty/tax free regulations, you must also declare the following:-

Declaring Restricted Goods

Item

|

Descriptions

|

Declare on Arrival

|

Declare on Departure

|

Firearms, weapons

and ammunition

|

You must declare all firearms, weapons and ammunition including real and replica firearms and BB air guns that discharge a pellet by means of compressed gas, commonly purchased as "toy" guns. Other weapons such as paintball markers, blowpipes, all knives, nunchukas, slingshots, crossbows, electric shock devices and knuckle dusters must also be declared. Some of these items may require a permit, police authorisation and safety testing before importation. |

Yes |

Yes |

Performance & image enhancing drugs |

All performance and image enhancing drugs must be declared on arrival. These include human growth hormone, DHEA and all anabolic and androgenic steroids. These items cannot be imported into Australia without a permit. |

Yes

|

Yes

|

Currency AUD10,000 or over

|

There is no limit to the amount of currency you can bring in or out of Australia. However, you must declare amounts of A$10,000 or more in Australian currency or foreign equivalent. If asked by Customs you must also fill in a Bearer Negotiable Instruments (BNI) form if you're carrying promissory notes, travellers cheques, personal cheques, money orders or postal orders. |

Yes

|

Yes

|

Food, plants, animals and biological goods

|

Declare all food, plant and animal goods, equipment used with animals, biological materials, soils and sand to Quarantine on arrival. If you don't, you could be given an on-the-spot fine or face prosecution. |

Yes

|

Yes

|

Medicinal products

|

You need to declare all drugs and medicines including prescription medications, alternative, herbal and traditional medicines, vitamin and mineral preparation formulas to Customs. Some products require a permit or quarantine clearance and/or a letter or prescription from your doctor describing your medication and medical condition. |

Yes

|

Yes

|

Protected wildlife and wildlife products

|

Australia ’s strict laws control the import and export of protected wildlife and associated products. This includes traditional medicinal products and regulated products such as coral, orchids, caviar, ivory products and many hunting trophies. |

Yes

|

Yes

|

Heritage-listed goods

|

You need to apply for a permit to import or export heritage-listed goods including works of art, stamps, coins, archaeological objects, minerals and specimens. |

Yes |

Yes

|

Veterinary products

|

Declare all veterinary drugs and medicines. This includes products that contain substances prohibited without a permit. |

Yes

|

Yes

|

Defence and strategic goods

|

Permits are required to import or export defence and strategic goods. For more information on which goods fit into this category, refer to Customs & Border Protection’s Export controls for defence & strategic goods factsheet at www.customs.gov.au |

Yes

|

Yes

|

Be aware that penalties for possession of drugs can result in heavy fines, imprisonment or even the death penalty in some countries.

Ask a Customs officer if you are in doubt about any articles over your duty/tax free allowance on the Incoming Passengers Card, which will be given to you just before arriving in Australia.

Arrange for sufficient medicines to meet your personal medical needs. Check with the embassy of the country you are visiting to ensure your medicine is legal there. Obtain a doctor's letter stating who the medicines are for, what they are, the dosage, and leave medicines in their original packaging. For more information, phone Medicare Australia's Travelling with PBS medicine inquiry line: 1800 500 147, or visit http://www.medicareaustralia.gov.au.

Don’t:-

Carry goods for other people. If you do and the goods are prohibited or restricted, you will be held responsible.

Believe you are "not the type". Customs officers may select people and their baggage for detailed examination for a number of reasons. Selection should not be seen as a reflection on a person's integrity or character.

Provide false or misleading information to Customs. Penalties for false information (such as false receipts) are severe and may result in your goods being taken from you.

Break the law in other countries. The power of the Australian Government is limited and you are subject to the laws of that country.

Expect your unaccompanied baggage to receive the same duty/tax free concessions as goods you bring with you.

Take prescription medicines subsidised under Pharmaceutical Benefits Scheme (PBS) overseas, unless they're for your own use or the use of someone travelling with you. A $5000 fine and/or a two-year jail sentence are the penalty for dealing with PBS medicine in a way other than which it was meant. For more information phone Medicare Australia's Travelling with PBS medicine inquiry line: 1800 500 147, or visit http://www.medicareaustralia.gov.au.

Bring back pirated and counterfeit goods. Copyright piracy and trade mark counterfeiting are illegal. In some circumstances pirated and counterfeit goods imported into Australia are liable to seizure by Customs and people importing such goods may be subject to civil litigation or criminal prosecution.

Duty-free concessions in Australia are different to those in other countries.

Most personal items such as new clothing, footwear, and articles for personal hygiene and grooming (excluding fur and perfume concentrates) may be brought into Australia in your accompanied baggage, free from duty and tax. Personal goods are free from duty and tax if they are:

- owned and used by you overseas for 12 months or more

- imported temporarily (a security may be required by Customs)

For other goods, limits apply. These include goods that are purchased overseas and goods that are purchased in Australia duty or tax free (that have been previously exported), or from an inwards duty free shop on arrival into Australia. Also included are goods for which a TRS claim has been made. Duty free concessions do not apply to commercial goods.

General goods

If you are aged 18 years or over, you can bring up to A$900 worth of general goods into Australia duty-free. If you are under 18 years of age there is a A$450 limit. General goods include gifts, souvenirs, cameras, electronic equipment, leather goods, perfume concentrates, jewellery, watches and sporting equipment.

Alcohol

If you are aged 18 years or over, you can bring 2.25 litres of alcohol duty-free into Australia with you. All alcohol in accompanied baggage is included in this category, regardless of where or how it was purchased.

Tobacco

If you are aged 18 years or over, you can bring 250 cigarettes, or 250 grams of cigars or tobacco products duty-free into Australia with you. All tobacco products in accompanied baggage are included in this category, regardless of where or how they were purchased.

Families travelling together can pool their duty-free concessions. Contact Customs for the definition of family.

Be aware that if you exceed Australia's duty-free concession limits you will be charged duty and tax on all items of that type (general goods, alcohol or tobacco), not just the items which exceed the limits.

If you have anything in excess of your duty free concession, declare the goods and provide proof of purchase to Customs for calculation of any duty and tax to be paid.

Failure to declare goods in excess of your concession could result in the application of penalties. If in doubt, contact a Customs officer or call 1300 363 263 ( Australia only) for information. If overseas, call +61 2 6275 6666 or email information@customs.gov.au.

About the Tourist Refund Scheme (TRS)

The TRS enables you to claim a refund, subject to certain conditions, of the goods and services tax (GST) and wine equalisation tax (WET) that you pay on goods you buy in Australia.

To claim a refund you must:

- Spend $300 (GST inclusive) or more in the one store and get a single tax invoice

- Buy goods no more than 30 days before departure

- Wear or carry the goods on board the aircraft or ship and present them along with your original tax invoice, passport and international boarding pass to a Customs Officer at a TRS facility

- Claims at airports are available up to 30 minutes prior to the scheduled departure of your flight.

- Claims at seaports should be made no earlier than 4 hours and no later than 1 hour prior to the scheduled departure time of the vessel.

The refund only applies to goods you take with you as hand luggage or wear (unless aviation security measures, effective from 31 March 2007, in regard to liquids, aerosols and gels prevent you from doing so) onto the aircraft or ship when you leave Australia. It does not apply to services or goods consumed or partly consumed in Australia, such as wine, chocolate or perfume. However, unlike other tourist shopping schemes, most of the goods, such as clothing and cameras, can be used in Australia before departure.

The TRS is open to all overseas visitors and Australian residents, except operating air and sea crew.

The GST refund is calculated by dividing the total amount of the purchase by 11. The WET refund is 14.5 percent of the price paid for wine. For example, if you buy goods for a GST-inclusive price of $660 you will receive a refund of $60. If the $660 is made up of a camera ($460) and wine ($200), you will receive a total refund of $89 (total GST refund of $60 plus $29 WET refund on the wine).

New aviation security measures, effective from 31 March 2007, will affect the amount of liquids, aerosols and gels (LAGs) that can be taken as hand luggage on flights into and out of Australia. Further information in regard to the new measures is available from the Department of Transport and Regional Services (DOTARS).

While TRS claims can still be made for liquids, aerosols and gels, those goods that cannot be taken on board as hand luggage due to the new aviation security measures should be packed in the traveller's hold luggage. However, if those goods are oversized, for example a case of wine, they must be sighted prior to check-in at the Customs Client Services counter.

Goods & Services Tax – GST

The GST rate is set at 10% of the price of the goods being sold or services being supplied. Everyone pays the tax on most things they purchase and most businesses must charge it on the things they sell or supply.

|